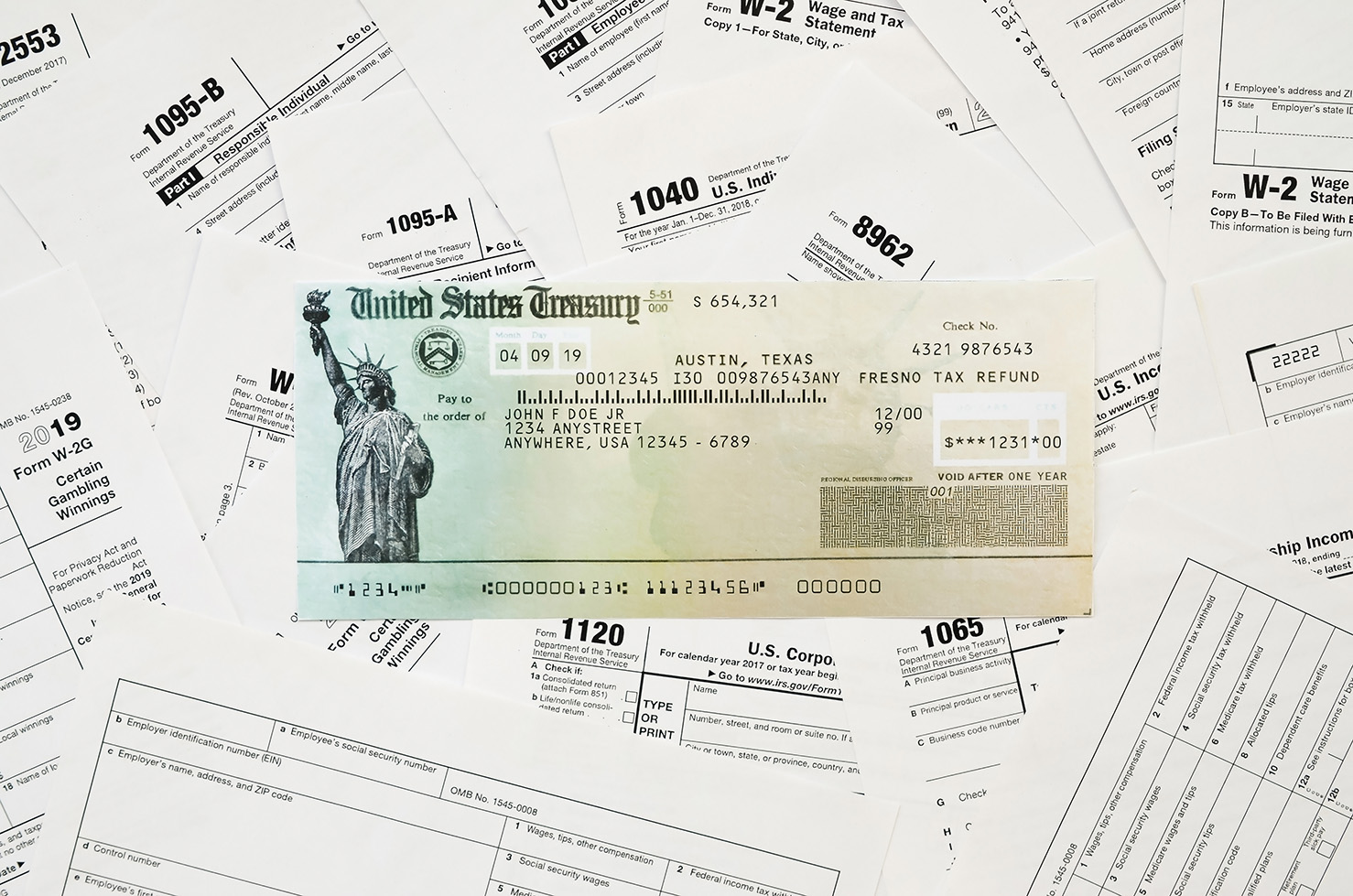

The Refund Advance is an optional tax-refund related loan provided by Pathward®, N.A., Member FDIC (it is not the actual tax refund) at participating locations. Program availability and loan amounts may vary based on state.

Loan amount options are based on your expected Federal refund less authorized fees. Loan is subject to underwriting and approval.

If approved the amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to you. Proceeds are typically available within 24 hours of IRS acceptance of tax return or within 24 hours for those filing before the IRS start date. If direct deposit is selected, it may take additional funding time depending on your financial institution to post the funds to your account.

Visit your local In & Out Tax office to learn about product options. Valid 1/2/25-2/28/25 Contact us 855-OUT-FAST

The ERC is your answer to the unbanked taxpayers who need or want a paper check. There are no upfront fees associated with this product. After the IRS deposits your refund, the bank will authorize us to print a refund check (minus our fees)

Filing electronically and choosing direct deposit is the fastest way to get access to your refund. This product disbursement type is not a loan.

No bank account learn how to open an account at an FDIC insured bank Click Here The IRS deposits your refund into your personal account minus our fees. Actual funding time will depend on your financial institution. There is no need to return to office.

Prepaid Mastercard is another option to choose, and provides a fast, free and seamless way to receive your tax refund. Have your money deposited directly onto the prepaid card given to you while in office with no upfront additional fees. Eliminating return trips to the office to pick up a check.

Contact us today for expert assistance with all of your accounting and tax needs. Our team of professionals is dedicated to providing you with top-notch service and maximizing your financial success.

Copyright © 2024 In & Out Tax Service. All rights reserved.